Overview of the Global Economy

The global economy comprises various interconnected national economies, creating a complex network of trade and investment. According to the International Monetary Fund (IMF), global growth was projected at 3.5% in 2023, indicating a steady yet moderate recovery from recent disruptions. Major economies, including the United States, China, and the European Union, play substantial roles in shaping global economic trends.

Developed economies generally show slower growth compared to emerging markets. For instance, while the US experienced steady growth at about 2.9%, China’s economy expanded faster, albeit at a slowing pace of around 4.8%. These variations affect global trade dynamics, influencing demand for goods and services, investment flows, and currency exchange rates.

Global trade policies also significantly impact the economy. Recent years have seen shifts such as the US-China trade tensions and Brexit, which introduced new tariffs and regulatory changes. These policy changes alter market access, complicate supply chains, and introduce uncertainty for businesses operating internationally.

Inflation rates and monetary policies of major economies further shape the global economic landscape. Central banks, like the Federal Reserve in the US and the European Central Bank, adjust interest rates to manage inflation and stimulate growth. Higher interest rates can slow down borrowing and spending, while lower rates aim to encourage economic activity.

Natural resources and energy prices represent another critical factor. Fluctuations in oil prices, driven by supply constraints or geopolitical events, can ripple through the global economy. For example, the significant rise in oil prices in early 2022 affected transportation costs, manufacturing expenses, and consumer prices globally.

Political stability and governance also play vital roles. Countries with stable political environments and strong governance structures tend to attract more foreign investment, fostering economic growth. Conversely, political instability can deter investment and disrupt economic development.

Looking ahead, technological advancements and digitization continue to transform the global economy. Innovations in areas like artificial intelligence, renewable energy, and biotechnology promise to create new opportunities and disrupt traditional industries. Businesses must stay adaptable to leverage these advancements for competitive advantage.

The global economy is dynamic and multifaceted, influenced by various factors including national growth rates, trade policies, monetary policies, natural resource prices, political stability, and technological advancements. Understanding these elements is crucial for businesses aiming to navigate the international economic landscape effectively.

Recent Economic Trends

Understanding recent economic trends is vital for businesses operating in the global market. These trends provide insight into potential opportunities and risks.

Growth and Contraction Patterns

Economic growth and contraction patterns differ across regions and sectors. For instance, emerging markets such as India and Vietnam are seeing robust growth due to industrial expansion and increased foreign investment. On the other hand, developed economies like the Eurozone are experiencing slower growth, influenced by factors such as aging populations and political uncertainties.

Key Examples:

- Emerging Markets: India’s GDP grew by 6.8% in 2023, while Vietnam’s rose by 7.2%, driven by manufacturing and technology sectors.

- Developed Economies: The Eurozone’s GDP growth remained around 1.2% in 2023, challenged by Brexit implications and inflationary pressures.

Key Economic Indicators

Key economic indicators offer insights into the health of an economy. Metrics such as GDP, inflation rates, and unemployment rates are critical for understanding economic conditions.

- GDP (Gross Domestic Product): In 2023, the global GDP growth reached 3.5%, reflecting a moderate post-pandemic recovery.

- Inflation Rates: The US experienced an inflation rate of 4.0% in 2023, which led the Federal Reserve to adjust interest rates.

- Unemployment Rates: The global unemployment rate stood at 5.8% in 2023, with marked variations between developed and developing nations.

Economic indicators, whether they’re showing growth or contraction, help businesses strategize and adapt to changing market conditions. Analyzing these trends enables informed decision-making and aids in mitigating risks while capitalizing on emerging opportunities.

Major Economic Challenges

Global economic challenges affect businesses’ strategic planning and operational decisions.

Inflation and Supply Chain Disruptions

Inflation rates increased significantly in many countries due to pandemic recovery efforts and fiscal policies. Rising costs of goods and services put pressure on businesses’ profit margins, leading to price adjustments. For example, in 2023, the US experienced an inflation rate of 6.5%, according to the Bureau of Labor Statistics.

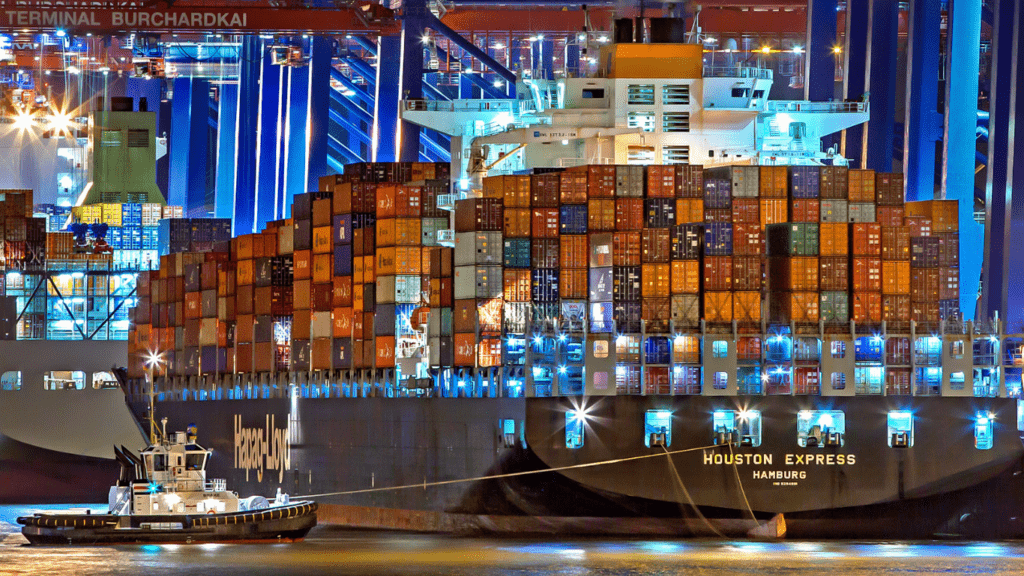

Supply chain disruptions also create challenges. The COVID-19 pandemic highlighted vulnerabilities in global logistics, with ports congested and shipment delays common. A survey by the Institute for Supply Management in 2023 found that 75% of businesses faced supply chain disruptions, resulting in production delays and increased costs. Businesses must re-evaluate their supply chains to enhance resilience and mitigate risks.

Geopolitical Tensions

Geopolitical tensions present uncertainties. Trade conflicts, such as US-China disputes, introduce tariffs and alter trade routes, complicating international operations. The US-China trade war, for instance, led to tariffs on $550 billion worth of goods, affecting industries from electronics to agriculture.

Political instability in key regions also impacts global markets. The Russia-Ukraine conflict strained Europe’s energy supply, leading to elevated energy prices and operational challenges for European businesses. Data from Eurostat indicated a 25% increase in energy costs across the Eurozone in 2023.

By considering these factors, businesses can strategize to navigate the complex global economy more effectively.

Impact on Global Businesses

In the ever-evolving global economy, businesses face diverse challenges and opportunities. Understanding how these factors affect different types of businesses is crucial for strategic planning.

Small and Medium Enterprises (SMEs)

SMEs often face unique challenges in a global economy. Currency fluctuations and trade policy shifts can impact their operating costs and pricing strategies. For instance, a weaker domestic currency increases import costs, affecting profit margins for businesses reliant on foreign goods.

SMEs, especially those in manufacturing, can be vulnerable to supply chain disruptions, which a survey revealed impacted 75% of businesses in 2023. These enterprises require agility to adjust to changing economic conditions quickly.

Technological advancements, such as e-commerce platforms, offer growth opportunities by expanding market access. However, adopting new technologies demands investment, a hurdle for some SMEs due to limited capital resources. For sustainable growth, SMEs should focus on diversifying supply sources and leveraging digital tools.

Multinational Corporations

Multinational corporations (MNCs) navigate the global economy with more resources but also more complexities. Geopolitical tensions such as the US-China trade war and Brexit can disrupt their extensive supply networks and increase compliance costs due to new tariffs and regulations.

For example, technology firms relocating manufacturing units from China to other countries faced increased operational costs. MNCs must also manage varying inflation rates across different markets, influencing pricing and wage adjustments.

A significant factor for MNCs is the adaptability to local markets, requiring a strategic balance between global integration and local responsiveness. Investing in advanced technologies and sustainable practices can provide a competitive edge. For continued success, MNCs should prioritize flexibility and innovation to navigate global economic shifts effectively.

Sector-Specific Effects

Global economic changes affect various sectors differently, creating both challenges and opportunities that demand strategic adaptations.

Technology and Innovation

Technology sectors thrive on innovation and investment. High demand for new technologies, like artificial intelligence and renewable energy solutions, drives growth. Tech companies see increased funding, particularly in cutting-edge fields such as quantum computing and autonomous vehicles. However, supply chain issues and semiconductor shortages pose significant obstacles. Companies must navigate these disruptions to maintain production schedules and meet market demands.

Manufacturing and Trade

Manufacturing sectors face significant impacts from global trade policies. Tariffs and trade barriers influence production costs and supply chain efficiency. For example, US-China trade tensions have led to higher tariffs on key manufacturing inputs. Additionally, fluctuations in raw material prices, like steel and aluminum, create pricing volatility. Manufacturers need to strategically relocate parts of their supply chains or invest in automation to mitigate these issues.

Retail and Consumer Goods

Retail and consumer goods sectors feel the direct impact of consumer behavior shifts. Inflation affects purchasing power, which influences sales volumes and profit margins. For instance, a 6.5% inflation rate in the US in 2023 led to increased prices for everyday items, causing consumers to prioritize essential over non-essential goods. Moreover, e-commerce growth requires retailers to enhance their online presence and logistics capabilities. Adopting omnichannel strategies has become essential for retailers to remain competitive and meet changing consumer preferences.

Future Outlook

The future outlook of the global economy presents both challenges and opportunities for businesses. Predicted economic scenarios and strategic business adaptations will significantly shape the landscape.

Predicted Economic Scenarios

Experts forecast varying economic outcomes based on current trends. As per the World Bank, global growth could moderate to around 3.1% in 2024. Developed economies may continue to experience sluggish growth due to mature markets and saturated demand. For example, the United States might see a growth rate of 2.1% while the European Union hovers around 1.5%.

Emerging markets, however, might witness stronger growth. The International Monetary Fund (IMF) anticipates that countries like India and Indonesia could sustain growth rates of 6.5% and 5%, respectively. Factors influencing these scenarios include:

- geopolitical tensions

- technological advancements

- energy prices

Geopolitical instability remains a significant concern. US-China relations and the Russia-Ukraine conflict introduce uncertainties that could hinder international trade and disrupt supply chains. If these tensions escalate, businesses may need contingency plans to mitigate associated risks.

Technological advancements are another key factor. Increasing investment in artificial intelligence and renewable energy may drive productivity and open new markets. Businesses embracing these technologies might gain a competitive edge.

Energy prices will also play a crucial role. Fluctuations in oil and gas costs affect transportation and production expenses globally. Rising energy prices can lead to higher consumer prices, impacting purchasing power.

Strategic Business Adaptations

Businesses must adapt strategically to thrive in this fluctuating environment. For SMEs, diversification of supply chains is essential to mitigate disruptions. Small businesses should leverage digital tools, like e-commerce platforms, to expand their market reach and improve efficiency.

MNCs need a different approach. They should balance global integration with local market responsiveness. Investing in advanced technologies and sustainable practices can enhance their competitive advantage. For example, adopting AI for operational efficiency and renewable energy for sustainability goals.

Another critical strategy involves cost management. With inflation rates impacting profit margins, businesses should optimize their operational costs. Streamlining processes and negotiating better terms with suppliers can help mitigate inflationary pressures.

Additionally, companies should focus on agility and resilience. Creating flexible business models can enable quick responses to economic shifts. Investing in employee training and development can foster a more adaptable workforce.

Staying informed about global economic trends is vital. Businesses must continuously monitor economic indicators and global events to make data-driven decisions. Subscribing to economic reports from reputable sources like the IMF and World Bank can provide valuable insights.

By understanding predicted economic scenarios and adopting strategic measures, businesses can navigate the complexities of the global economy more effectively.