Technology and Innovation

Investing in technology and innovation presents some of the most significant opportunities in today’s market. Key areas include artificial intelligence, blockchain technology, and renewable energy.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are driving innovation across industries. AI powers applications like natural language processing in virtual assistants and predictive analytics in finance. According to Grand View Research, the AI market will reach $390.9 billion by 2025. Key companies, including Google and Microsoft, invest heavily in AI research and development. AI’s applications span areas like healthcare diagnosis, self-driving cars, and fraud detection.

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies are transforming financial systems. Bitcoin, Ethereum, and other cryptocurrencies offer decentralized financial solutions. Markets and Markets forecasts the blockchain market will grow to $39.7 billion by 2025. Blockchain applications include secure financial transactions, transparent supply chain management, and smart contracts. Companies like IBM and Coinbase promote blockchain adoption, seeing its potential beyond cryptocurrencies.

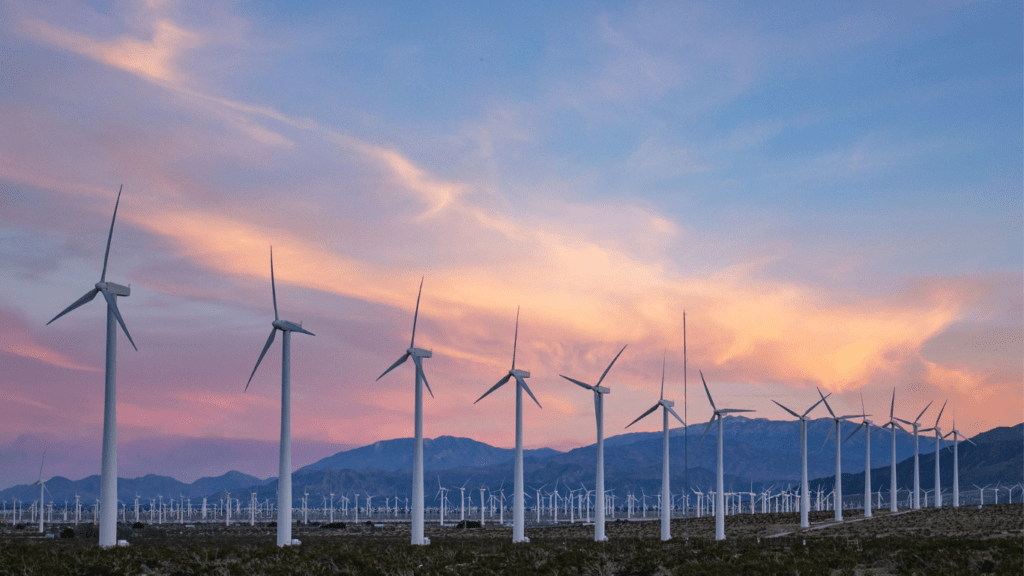

Renewable Energy

Renewable energy technologies are essential for sustainable development. Solar power, wind energy, and electric vehicles (EVs) are critical sectors. The International Energy Agency projects renewable energy capacity will expand by 50% between 2019 and 2024. Companies like Tesla and NextEra Energy lead in renewable energy investments. Innovations in battery storage and grid management are crucial for scaling these technologies.

Healthcare and Biotechnology

Investing in healthcare and biotechnology offers substantial growth potential due to ongoing advancements and increasing global health needs.

Telemedicine

Telemedicine has become a critical component of modern healthcare. The global telemedicine market was valued at $49.9 billion in 2019 and is projected to reach $194.1 billion by 2023 (Fortune Business Insights). Major players like Teladoc Health and Amwell are leading the market, making telemedicine an attractive investment. Telemedicine provides remote clinical services via telecommunications technology. This innovation reduces healthcare costs and improves access to medical care, particularly in rural areas. Remote monitoring, virtual consultations, and electronic health records (EHRs) have streamlined patient care and increased efficiency.

Genomics and Personalized Medicine

- Genomics and personalized medicine represent a transformative shift in healthcare.

- The global genomics market is expected to reach $35.7 billion by 2024 (MarketsandMarkets).

- Companies like Illumina and 23andMe are pioneers in this space, facilitating genetic sequencing and analysis.

- Personalized medicine tailors treatments to individual genetic profiles, enhancing effectiveness and reducing side effects.

- This approach includes pharmacogenomics, which helps determine the best drugs for a person based on their genetic makeup.

- Significant investments in genomics research are accelerating the development of new diagnostic tools and targeted therapies, paving the way for breakthroughs in treating various diseases.

E-commerce and Online Services

Investing in e-commerce and online services offers potential for substantial returns. The rise of digital platforms creates significant opportunities in this sector.

Online Retail

Online retail continues its rapid growth as consumers increasingly prefer digital shopping. In 2022, global e-commerce sales reached $5.7 trillion, highlighting the sector’s vitality. Companies like Amazon and Alibaba dominate, but niche markets also present investment opportunities. Direct-to-consumer brands (e.g., Warby Parker and Glossier) capitalize on personalized customer experiences and efficient supply chains. As mobile commerce gains more traction, businesses optimizing for mobile platforms could see significant gains.

Food Delivery Services

The food delivery industry has seen explosive growth, fueled by convenience and pandemic-induced demand. The global market size for food delivery services hit $150 billion in 2021. Leading platforms like:

- DoorDash

- Uber Eats

- Grubhub

are key players. Despite the market’s competitive nature, there’s potential in specialized niches like healthy meals or local cuisine-focused services. Subscription-based services (e.g., Blue Apron and HelloFresh) are also gaining popularity, offering sustainable and consistent revenue streams for investors.

Real Estate and Property Development

Investing in real estate and property development offers stable returns and long-term growth. Economic and population growth drive demand for residential, commercial, and industrial properties.

Sustainable Construction

Sustainable construction isn’t just a trend; it’s a necessity. Green buildings reduce environmental impact and operating costs while increasing property value. According to the U.S. Green Building Council, LEED-certified buildings command higher rent and sale prices. Companies like Skanska and Turner Construction lead in incorporating eco-friendly materials and energy-efficient designs. Investors should focus on projects with sustainable certifications for better returns.

Urban Housing Projects

Urban housing projects present lucrative opportunities due to increasing urbanization. The United Nations predicts that by 2050, 68% of the world’s population will live in urban areas. Cities need affordable and efficient housing solutions to accommodate this growth. Companies like AvalonBay Communities and Equity Residential excel in developing high-density, mixed-use properties. Investing in urban housing developments aligns with this demographic shift, offering consistent demand and appreciation.

Financial Services

Investing in financial services offers diverse opportunities due to ongoing digital transformation and evolving consumer needs. Here are two key areas for consideration.

Fintech Startups

Fintech startups redefine how financial services are delivered, integrating technology for enhanced user experiences. With global fintech investments reaching $210 billion in 2021, it’s evident this sector holds substantial potential. Companies like Stripe and Robinhood lead the charge with innovative payment systems and investment platforms. Stripe simplifies online payments for businesses globally, while Robinhood democratizes stock trading through user-friendly mobile apps. Investing in fintech startups can capitalize on the increasing demand for digital financial solutions.

Digital Banking

Digital banking transforms traditional banking models by offering online and mobile services without physical branches. The digital banking market is expected to grow to $1 trillion by 2026, supported by institutions like Chime and Revolut. Chime focuses on fee-free banking, attracting millions of users with its user-centric approach. Revolut, providing international money transfers and cryptocurrency trading, offers a comprehensive digital financial ecosystem. Investing in digital banking paves the way for tapping into the growing preference for online financial services.